Accurate paycheck calculator

Get a free quote today. Ad Calculate Your Payroll With ADP Payroll.

Paycheck Calculator Us Apps On Google Play

Just enter the wages tax withholdings and.

. Taxes Paid Filed - 100 Guarantee. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Heres a step-by-step guide to walk you through.

This free easy to use payroll calculator will calculate your take home pay. Salary Paycheck Calculator This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Get 3 Months Free Payroll.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Get an accurate picture of the employees gross pay. Enter your employees pay information.

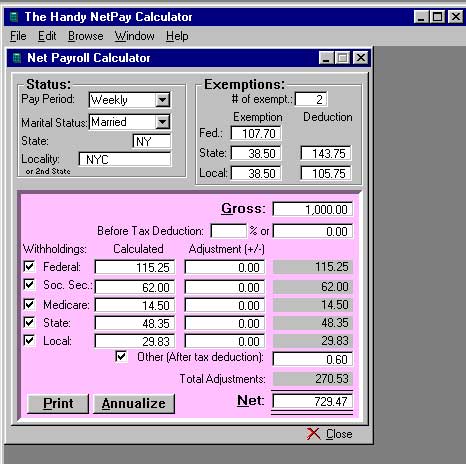

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. We do all the hard work for you. 5 star service with 247 support.

In a few easy steps you can create your own paystubs and have them sent to your email. California Paycheck Calculator Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Ad Create professional looking paystubs.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. The estimated tax payment deadline for the third quarter is Thursday Sept.

This number is the gross pay per pay period. Ad Calculate Your Payroll With ADP Payroll. Process Payroll Faster Easier With ADP Payroll.

For example if an employee earns 1500 per week the individuals annual. Get 3 Months Free Payroll. No need to deal with any complicated calculations.

Supports hourly salary income and multiple pay frequencies. We do all the hard work for you. Heres a step-by-step guide to.

Subtract any deductions and. No need to deal with any complicated calculations. Payroll So Easy You Can Set It Up Run It Yourself.

We use the most recent and accurate information. For single filer you will receive. Total annual income - Tax liability All deductions Withholdings Your annual paycheck How much is a paycheck on 40000 salary.

Taxes Paid Filed - 100 Guarantee. Ad Easy To Run Payroll Get Set Up Running in Minutes. Heres a step-by-step guide to walk you through.

Ad Compare This Years Top 5 Free Payroll Software. Ad Your own customized pay stub made professionally. Get Started With ADP Payroll.

All inclusive payroll processing services for small businesses. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. 5 star service with 247 support.

The app calculates paycheck for all 52 states and for all filing status and pay periods. For example if you earn 2000week your annual income is calculated by. Next divide this number from the annual salary.

Process Payroll Faster Easier With ADP Payroll. Get a free quote today. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Get Started With ADP Payroll. The Payroll Calculator application is here to double check your paycheck. Free Unbiased Reviews Top Picks.

It can also be used to help fill steps 3. Which is your gross minus standard deduction which was 124K for 2020 So if the total you made was 424K for the year - you pay zero on the first 124K 10 on the next 10K and 12 on. Ad Your own customized pay stub made professionally.

Computes federal and state tax withholding for. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. The personal income tax rates in California.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right.

Simply enter their federal and state W-4 information as well as their. Ad Accurate Payroll With Personalized Customer Service. This free paycheck calculator makes it easy and hassle-free for you to calculate pay for all your workers including hourly wage earners and salaried employees.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll For Hourly Employees Sling

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calc Flash Sales Save 39 Srsconsultinginc Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

W 2 1099 Filer Software Net Pr Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Paycheck Calculator Hourly Salary Usa Dremployee

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp